Real Estate News

-

Relative Price Stability and a Propensity for Buyers and Sellers to Wait, in the Last Quarter of 2022

Press release

Centris Residential Sales Statistics – 4th quarter of 2022L'Île-des-Sœurs, January 12, 2023 – The Quebec Professional Association of Real Estate Brokers (QPAREB) has just released its quarterly residential real estate market statistics for the province of Quebec, based on the real estate brokers' Centris provincial database.

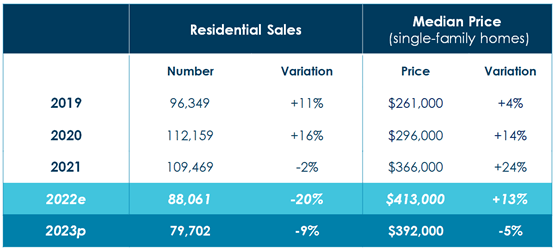

The past year was marked by a notable slowdown in market activity. There were 87,204 residential sales across the province in 2022. This represents a 20 per cent drop in sales from the previous year, a historic decline after exceptionally high levels of activity during the pandemic period. This decline increased in the second half of the year. The fourth quarter saw sales fall to a level not seen since 2014 for this time of year.

The acceleration of the downward trend must be put into context, however, as 2022 is still above the average for the last decade. Indeed, the year shows the fourth-highest level of sales since the Centris system for real estate brokers has been compiling data.

"The magnitude and speed of the interest rate increase began to materialize in the third quarter of the year. There was a sharp decline in the ability of buyers to qualify for mortgage financing. The fourth-quarter results reflect more tangibly the impact of this phenomenon on sales, but also the generalized wait-and-see attitude of buyers who anticipate that market conditions will continue to deteriorate in their favour. This deterioration had already been reflected in the third quarter by a significant drop in prices compared to the second quarter, in the markets that had been most exposed to overheating and overbidding," said Charles Brant, Director of the QPAREB's Market Analysis Department. "It is interesting to note that market conditions deteriorated only very gradually in the fourth quarter, despite the sharp decline in sales. They remain clearly favourable to sellers. While, indeed, in a context of lower activity, we generally see a backlog of properties that are not finding takers on the market, new listings are down in the fourth quarter. This is a rather unusual situation in such a bear market. This context is indicative of sellers' propensity to wait before lowering their price or to temporarily withdraw their property from the market. Potential sellers, on the other hand, are still able to wait for conditions to stabilize before putting their property on the market. This situation explains the reduced number of forced sales and repossessions. As a result, home prices remained relatively stable in the last quarter of the year, both in comparison with last year and the previous quarter," he explains.

Annual Highlights for the Province

Sales

- Across the province, the decline in transactional activity was observed in all property categories, with variations between -18 per cent and -27 per cent. Plexes with two to five units stood out with a more significant decline in sales (-27 per cent in one year). Condominiums and single-family homes registered declines of -22 per cent and -18 per cent, respectively.

- In terms of metropolitan areas, the Montreal and Gatineau CMAs registered the largest decreases, at -22 per cent and -21 per cent. Sales were also down in the Sherbrooke (-17 per cent), Saguenay (-17 per cent) and Quebec City (-13 per cent) CMAs. Finally, with a decrease of -8 per cent compared to last year, the Trois-Rivières CMA had the smallest decrease in transactional activity.

- Among the smaller urban centres, some localities stood out with a more significant decrease in sales between 2021 and 2022. Mont-Tremblant had the largest drop in sales, with a -44 per cent decrease over the past year. The markets of Salaberry-de-Valleyfield (-30 per cent), Saint-Sauveur (-27 per cent) and Sainte-Adèle (-27 per cent) also registered significant decreases.

- A group of small urban centres was closer to the provincial average (-20 per cent), with sales decreasing by between -9 per cent and -26 per cent. Among the localities that registered a more pronounced decline than the province were Sorel-Tracy (-24 per cent) and Granby (-21 per cent). The markets of Shawinigan (-15 per cent), Joliette (-14 per cent) and Saint-Hyacinthe (-14 per cent) were among those that slowed down less.

- Finally, the Drummondville market saw its transactional activity remain steady, with an annual variation of +2 per cent.

Active Listings

- Active listings reached 26,340 in 2022, according to the Centris system, for an annual increase of +5 per cent. This is a sign of the rebalancing process that is gradually taking place in the real estate market, as this is the first increase in active listings since 2015. In reality, the increase in listings is more of a process of accumulating properties that are not finding takers on the market, rather than the tangible addition of new listings, month after month. This leads to a fairly slow uptick in the time it takes to clear the property inventory on the market.

Median Price

- Province-wide, the median price of single-family homes was $415,500, an increase of +14 per cent between 2021 and 2022.

- The median price of condominiums registered an increase of +12 per cent to reach $366,000 in 2022.

- The median price of small income properties has also been growing in the past year. With a +10 per cent increase from last year, the median price of plexes now stands at $505,000.

Market Conditions

- Despite declining sales and a trend towards the accumulation of residential properties, the market still strongly favours sellers in the province. This is reflected in a slight increase in the number of months it takes to clear the inventory of residential properties on the market. The number of months required to clear the inventory is 3.6 months (all categories combined) in 2022.

Selling Times

- As a sign of the continuing tension in the province's single-family home market, the average selling time was 41 days in 2022, 10 days less than a year earlier. It should be noted that the sale time for single-family homes has never been this low since 2000.

Quarterly Highlights for Metropolitan Areas

- For a third consecutive quarter, residential sales are down in the Montreal CMA. With 7,692 properties sold on the residential market, this represented a -37 per cent decrease compared to the fourth quarter of 2021. Condominiums and plexes registered the largest drops, with decreases of 40 per cent and 52 per cent, respectively. For their part, single-family homes experienced a more modest decrease in sales at -32 per cent.

- The number of months required to clear the inventory of residential properties in the Montreal market was 3.5, a slight increase for the fourth quarter of 2022. Several sectors on the outskirts of the Island of Montreal showed signs of weakness with a significant increase in active listings. In total, there were 15,543 active listings in the CMA, an increase of +60 per cent compared to the same period a year ago. Such an inventory, which is still very low, has not been observed in the Montreal CMA territory since the fourth quarter of 2019.

- Price corrections were modest in the Montreal CMA, due specifically to activity slowed by the rapid rise in interest rates and the disappearance of the overbidding phenomenon. In a quarter-over-quarter comparison, median prices decreased by -4 per cent for single-family homes, -1 per cent for condominiums and -3 per cent for plexes.

- With 1,775 sales transactions in its territory, the Quebec City CMA saw its activity decrease by -26 per cent in the fourth quarter of 2022 compared to the same period a year ago. However, this represented 107 more sales (+6 per cent) than in the previous quarter. This growth was attributable to an increase in plex sales (+19 per cent) and single-family home sales (+7 per cent). Condominium sales remained stable (0 per cent).

- In the fourth quarter of 2022, active listings reached 3,028, up by only 7 per cent compared to the same period a year ago. Single-family homes, followed by plexes, were the categories with the most significant accumulation of properties for sale on the market, with increases of +24 per cent and +14 per cent respectively. However, the increase was not generalized to all property categories. Indeed, there were 825 condominiums available in the Quebec City CMA. This represented a decrease of -19 per cent compared to the fourth quarter of 2021, but an increase of +11 per cent compared to the previous quarter.

- Despite a slowdown in transactional activity, price adjustments were very limited in the Quebec City CMA during the last quarter. The median price of small income properties and condominiums decreased by -1 per cent and -5 per cent, respectively, compared to the third quarter of 2022. The median price of single-family homes registered a small positive change (+1 per cent).

- Across the Gatineau CMA, 858 sales were made in the fourth quarter of 2022. This represents a -32 per cent decrease in transactional activity compared to the same period last year. Note that you have to go back to the fourth quarter of 2017 to see such a low level of activity in the CMA. Although activity was down across all property categories, the decline from a year ago was most pronounced in the plex category (-51 per cent). Condominium and single-family home sales were down by 39 per cent and

27 per cent, respectively. - Although down slightly from the previous quarter, there were 1,186 active listings in the Gatineau CMA. This level of property inventory represents +82 per cent more listings than in the fourth quarter of 2021. Despite this accumulation of properties on the market, the number of months to clear the inventory remains below the 3-month mark, at 2.6 months. It should be noted that the number of months to clear inventory is even lower for single-family homes (2.5 months) and condominiums (2.3 months).

- The median price correction was greatest for plexes in the fourth quarter of 2022, with a -13 per cent decrease from the previous quarter. Single-family homes and condominiums declined by -4 and -5 per cent, respectively. It should be noted, however, that on an annual basis, median prices are fairly stable with changes between -1 per cent and +6 per cent.

- With 412 transactions completed in the fourth quarter of 2022, sales in the Sherbrooke CMA were down by -22 per cent compared to the same period last year. All three major property categories also registered a year-over-year decline, with single-family homes down 21 per cent, condominiums down 20 per cent and plexes down 24 per cent.

- Active listings in the Sherbrooke CMA increased by +39 per cent compared to the same quarter last year. This increase was driven by single-family homes, whose listings rose by +53 per cent. Condominiums and plexes also registered an increase in their inventory of available properties, with variations of

+13 per cent and +28 per cent. The number of months required to clear inventory is up, but remains very low at 2.9 months (all categories combined). - In the fourth quarter of 2022, the median price for small income properties was $382,500 and was up

+20 per cent from the same period a year ago. With an increase of +11 per cent, the median price of condominiums reached $265,900. Single-family homes were sold at a median price of $350,000, an increase of +9 per cent. It should be noted, however, that when comparing the median prices to those of the third quarter of 2022, the price of condominiums is down slightly (-2 per cent), while the other two categories are still recording increases.

- The market slowdown is less felt in Trois-Rivières, with a -16 per cent decline in residential sales compared to the fourth quarter of 2021. With 329 sales, this quarter recorded a comparable level to the fourth quarter of 2019 (332 sales). 2019 was already a record year for pre-pandemic sales for this metropolitan area. Still, declines of -25 per cent and -24 per cent were reached for plexes and condominiums respectively. While the decline is only -9 per cent for single-family homes.

- In the Trois-Rivières CMA, active listings followed the general trend for this fourth quarter, with an increase of +16 per cent compared to the same quarter last year. There were 302 active listings for this last quarter of the year 2022. This is also a continuous increase in consecutive quarters since the beginning of the year. This increase is primarily explained by single-family homes and condominiums, while the number of active listings for small income properties is down -18 per cent from last year. The number of months required to clear the inventory is up to 2.2 months (all categories combined).

- On an annual basis, median prices increased for all residential categories, with plexes increasing by

+6 per cent to $259,950, condominiums by +15 per cent to $232,500 and single-family homes by +20 per cent to $284,500. However, despite this annual increase, a decrease for plexes and single-family homes is observable, if we compare this last quarter with the third of 2022.

- With 212 sales in the fourth quarter of 2022, the Saguenay CMA recorded a -37 per cent decrease compared to the fourth quarter of 2021. This is close to its pre-pandemic level. The decreases are present in all property categories, particularly for plexes and single-family homes, with -40 per cent and -38 per cent, respectively, compared to the same quarter last year.

- Active listings, as in most areas of Quebec, have stopped decreasing compared to previous years. In fact, for the first time since the first quarter of 2019, they are stable compared to the last quarter of last year, with 462 active listings. With 3.9 months to clear residential property inventory, this is the first time since the third quarter of 2017, that the number of months is up from the previous quarter. This is due to an increase in active listings and a level of sales comparable to pre-pandemic data.

- Compared to the third quarter of 2022, median prices are down in the various residential categories. However, only for small income properties are median prices also declining on an annual basis, by

-4 per cent.

Quarterly Highlights for Large Agglomerations (excluding CMAs)

Sales

- Urban centres outside of metropolitan areas recorded 2,444 sales in the fourth quarter of 2022, down -26 per cent from the same period last year. This downward trend was driven by some markets that experienced a larger decline. This was the case in Mont-Tremblant (-44 per cent), Sainte-Adèle (-39 per cent), Saint-Hyacinthe (-38 per cent), Salaberry-de-Valleyfield (-37 per cent), Granby (-32 per cent) and Joliette (-32 per cent). Other localities experienced a smaller than average decline. These communities included Saint-Sauveur (-25 per cent), Sorel-Tracy (-21 per cent) and Shawinigan (-18 per cent).

- For single-family homes, the decline in sales was -22 per cent in the fourth quarter of 2022 compared to the same period a year ago. Markets such as Mont-Tremblant (-49 per cent), Sainte-Adèle (-37 per cent), Granby (-37 per cent), Salaberry-de-Valleyfield (-30 per cent), Saint-Hyacinthe (-28 per cent) and Joliette (-23 per cent) registered the largest decrease in sales. Some markets, such as Shawinigan

(-19 per cent) and Sorel-Tracy (-9 per cent), registered a more modest decrease in sales. - The decline in condominium sales was -35 per cent in the fourth quarter of 2022 compared to the same period a year ago.

Active Listings

- Active listings in urban centres outside of metropolitan areas increased by +28 per cent compared to the same quarter last year. This increase was driven by condominiums, where listings rose by +52 per cent. Single-family homes also saw an increase in the accumulation of properties available for sale on the market, with a +31 per cent change. The number of months required to clear the inventory is up to 3.7 months (all categories combined).

- This upward trend is driven by certain markets that have experienced stronger growth. This was the case in Saint-Sauveur (+78 per cent), Joliette (+56 per cent), Granby (+53 per cent), Sainte-Adèle (+46 per cent), Drummondville (+39 per cent), Sorel-Tracy (+33 per cent) and Mont-Tremblant (+29 per cent). Other localities experienced a smaller than average increase. These included Saint-Hyacinthe (+13 per cent), Salaberry-de-Valleyfield (+14 per cent) and Shawinigan (+7 per cent).

Median Price

- In the fourth quarter of 2022, the trend is finally catching up with that of the agglomerations outside the CMAs. The median price of single-family homes was $305,000, an increase of only +3 per cent compared to the same period last year. It should be noted that this was a -3 per cent decrease from the previous quarter. The majority of urban centres outside of metropolitan areas saw a price increase between the fourth quarter of 2021 and the fourth quarter of 2022. However, the picture is more nuanced, with both positive and negative changes, when comparing the change between the last two quarters of 2022.

- Condominiums, for their part, recorded an increase in their median price of +20 per cent compared to the fourth quarter of 2021. The median price reached $295,000 in the fourth quarter of 2022. The change between the last two quarters was smaller (-1 per cent).

-

Quebec City's Activity Continues to Normalize and Listings Only Increase Moderately in December

Press release

Centris Residential Sales Statistics – December 2022

Quebec City Census Metropolitan Area (CMA)Quebec City, January 5, 2023 – The Quebec Professional Association of Real Estate Brokers (QPAREB) has just released its residential real estate market statistics for the month of December 2022. The most recent market statistics for the Quebec City Census Metropolitan Area (CMA) are based on the real estate brokers' Centris provincial database.

The Quebec City CMA recorded 461 residential sales in its area during the month of December 2022. This represents a decrease of 282 transactions or 38 per cent compared to 2021. This is a level of sales that is barely below the historical average for the month of December.

"In Quebec City, even though December is not the most representative month for real estate market dynamics, we can see that weaker sales are not solely due to rising interest rates. Properties are not coming onto the market at the same pace as they are in most other CMAs and agglomerations," said Charles Brant, Director of the QPAREB's Market Analysis Department. "Activity still seems to be limited, in part, by the lack of available properties on the market. The normalization of the market is therefore only partially complete for the moment and the process of rebalancing between supply and demand is very gradual. The result is continued price stability."

December Highlights

- The major sectors of the Quebec City CMA did not escape the annual downward trend in sales. The major sector of the Northern Periphery of Quebec City, with 35 transactions, stood out with a notable decrease of -65 per cent compared to the same period last year. The other two major sectors, the Agglomeration of Quebec City and the South Shore of Quebec City, with 334 sales and 92 sales, respectively, registered a 34 per cent decrease in sales.

- Condominium and single-family home sales registered the largest annual decrease for the current period. With 123 and 289 transactions, respectively, the decreases amounted to -43 per cent and -37 per cent. Small income properties, with 47 transactions, registered a decline that was smaller than the CMA average, at -30 per cent.

- After seven consecutive months of growth, active listings were down in the Quebec City CMA in December, a customary phenomenon for this time of year. With a total of 2,948 listings, this was a 5 per cent decrease compared to the previous month. Despite this decrease, active listings are higher than the level recorded at the same time last year (December 2021).

- On an annual basis, median prices remained relatively stable in the Quebec City CMA. Single-family homes and plexes registered increases of +3 per cent and +4 per cent, respectively. The median price of single-family homes was $328,000 and that of plexes was $364,000. The median price of condominiums reached $222,500, a slight decrease of -1 per cent or $2,500 compared to the same period one year ago.

Additional information:

Detailed and cumulative statistics for the province and regions

If you would like additional information from the Market Analysis Department, such as specific data or regional details on the real estate market, please This email address is being protected from spambots. You need JavaScript enabled to view it.

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 14,000 real estate brokers and agencies. It is responsible for promoting and defending their interests while taking into account the issues facing the profession and the various professional and regional realities of its members. The QPAREB is also an important player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Quebec's residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination, and exchange of information. The QPAREB has its head office in Quebec City, administrative offices in Montreal and a regional office in Saguenay. It has two subsidiaries: Société Centris inc. and the Collège de l'immobilier du Québec. Follow its activities at qpareb.ca or via its social media pages: Facebook, LinkedIn, Twitter and Instagram.

About Centris

Centris is a dynamic and innovative technology company in the real estate sector. It collects data and offers solutions that are highly adapted to the needs of professionals. Among these solutions is Centris.ca, the most visited real estate website in Quebec.

-

The Montreal Market Closes the Year with a Limited Price Decrease Despite a Sharp Decrease in Sales

Press release

Centris Residential Sales Statistics – December 2022

Montreal Census Metropolitan Area (CMA)L'Île-des-Sœurs, January 5, 2023 – The Quebec Professional Association of Real Estate Brokers (QPAREB) has just released its residential real estate market statistics for the month of December 2022. The most recent market statistics for the Montreal Census Metropolitan Area (CMA) are based on the real estate brokers' Centris provincial database.

Residential sales in the Montreal CMA reached 2,232 units in December 2022. This was a significant decrease of 1,414 transactions or 39 per cent compared to the same period last year. It should be noted that we have to go back to 2014 to see such a low level of sales in December.

"December is the month of the year when there are generally fewer listings and fewer purchases, so it is not surprising to see slower activity in the Montreal market. This phenomenon is particularly evident in the number of new listings (we have to go back to 2002 to see a similar level). This low level of inventory has nevertheless prevented prices from falling more sharply," notes Charles Brant, Director of the QPAREB's Market Analysis Department. "Although December is generally not the month that best reflects actual market dynamics, there is a certain wait-and-see attitude. On the one hand, buyers are hoping that market conditions will improve in their favour. Sellers, on the other hand, are hoping for a stabilization of the market. Active listings continue to rise significantly due to a build-up effect, which could help to vindicate buyers in the coming months," he adds.

December Highlights

- Overall, the annual downward trend in activity continued in all of the major sectors of the Montreal CMA, with transactional decreases ranging from -33 per cent to -52 per cent. The Saint-Jean-sur-Richelieu major sector, with 47 transactions during the period, registered the largest decrease in sales, at 52 per cent. The major sectors of Laval (200 sales), the Island of Montreal (836 sales) and the South Shore of Montreal (512 sales) were also below the CMA average (-39 per cent), with decreases of -41, -40 and -40 per cent, respectively. Finally, the major areas of the North Shore of Montreal and Vaudreuil-Soulanges followed, with 527 and 110 transactions, respectively, both registering decreases of -33 per cent compared to the same period one year ago.

- The slowdown in activity continued in all property categories, as sales of small income properties in December reached a new low, not recorded since 2000. Plex sales (221 sales) experienced the largest annual decline with a -51 per cent drop. Condominium and single-family home sales also decreased, with 872 and 1,135 transactions, respectively, down -40 per cent and -35 per cent in December.

- In line with what is usually observed in December of each year, the number of active listings in the Montreal CMA was down compared to November. Nevertheless, listings are sharply up compared to the month of December 2021. Indeed, with 14,533 active listings, the Montreal market has 6,632 more listings, or an 84 per cent increase, than at the same time last year. This increase is well above the provincial average (56 per cent). The increases are particularly pronounced on the outskirts of the Island of Montreal. However, it is necessary to keep these variations in perspective since, in absolute terms, the number of active listings is still well below the historical average of more than 21,000 listings.

- On an annual basis, median prices in the Montreal CMA registered decreases ranging from -1 per cent to -6 per cent. With a median price of $690,000, plexes were the segment that registered the largest decrease, falling by 6 per cent for an annual variation of $45,000. For their part, with decreases of -$15,000 and -$4,000, respectively, the median prices of single-family homes and condominiums remained more stable with decreases of -3 per cent and -1 per cent. The median prices were $510,000 and $357,000.

- On a consecutive monthly basis, a slight decline in median prices, between -1 per cent and -3 per cent, is also observable between November and December of 2022 in all property categories. Small income properties still have the largest monthly variation, with a change of -$25,000 for a -3 per cent decline. On the single-family and condominium side, the decreases are more modest, with declines of, respectively, -$10,000 (-2 per cent) and -$5,000 (-1 per cent).

- The most significant decreases in median prices for single-family homes, compared to last year, were observed in Saint-Jean-sur-Richelieu. On the other hand, Vaudreuil-Soulanges is the only major sector to register a positive price variation.

Additional information:

Detailed and cumulative statistics for the province and regions

If you would like additional information from the Market Analysis Department, such as specific data or regional details on the real estate market, please This email address is being protected from spambots. You need JavaScript enabled to view it.

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 14,000 real estate brokers and agencies. It is responsible for promoting and defending their interests while taking into account the issues facing the profession and the various professional and regional realities of its members. The QPAREB is also an important player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Quebec's residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination, and exchange of information. The QPAREB has its head office in Quebec City, administrative offices in Montreal and a regional office in Saguenay. It has two subsidiaries: Société Centris inc. and the Collège de l'immobilier du Québec. Follow its activities at qpareb.ca or via its social media pages: Facebook, LinkedIn, Twitter and Instagram.

About Centris

Centris is a dynamic and innovative technology company in the real estate sector. It collects data and offers solutions that are highly adapted to the needs of professionals. Among these solutions is Centris.ca, the most visited real estate website in Quebec.

-

2022: a Turning Point Towards a More Balanced Market in 2023

L'Île-des-Sœurs, December 13, 2022 — At its Fenêtre sur le Marché Immobilier conference, the Quebec Professional Association of Real Estate Brokers (QPAREB) presented its 2022 review and 2023 forecast for the residential real estate market for the province of Quebec and different regions.

- 2022 REVIEW | PROVINCE OF QUEBEC

2022 registered a record median price for all property categories, led by the single-family category, which saw a 13 per cent increase in price over 2021. However, sales dropped by 20 per cent in 2022, a historic decline after reaching exceptional levels of activity for most of the pandemic period. With an estimated 88,000 sales according to the real estate brokers' Centris provincial database, the year nevertheless ranked well above the averages of the past ten years, in term of activity.

"It turns out that the magnitude of interest rate increases defied all predictions. The key interest rate rose by 4 percentage points in less than 10 months, primarily due to runaway inflation and the outbreak of the Ukraine conflict. The resulting resale market turbulence over the first six months of the year was fuelled by the number of variable rate mortgages," explains Charles Brant, Director of the QPAREB's Market Analysis Department.

This sharp decline in activity is not reflected, over the year as a whole, by a drop in the median price for single-family homes in Quebec. According to QPAREB estimates, it will reach a record level of $413,000 in 2022, an average increase of 13 per cent compared to 2021. Since this variation is calculated based on the average annual median price, it is important to note that the median price of a single-family home in Quebec peaked in May 2022. Since then, monthly median prices have been consecutively trending downward.

The sharp rise in interest rates led to a price correction in the second part of 2022 after recording strong gains at the start of the year

The price correction, in response to the rapid rise in interest rates, is attributable in particular to the growing inability of buyers to qualify for a mortgage. As a result, the decrease in the number of buyers competing for a property quickly led to an easing of overheated conditions and a drop in the number of sales following an overbidding process.

"The overbidding phenomenon reached its peak at the start of 2022 due to the combination of two factors: the anticipation of interest rate hikes by the Bank of Canada as well as by floor-level variable mortgage rates at the same time as rising fixed mortgage rates at the end of 2021. This combination created a sense of urgency to acquire a property, all categories combined, in many regions of Quebec."

As a consequence of the several consecutive aggressive increases in the key interest rate, overbidding lost its intensity. Prices immediately moved closer to their true values in line with the long-term trend, erasing the excessive early-year gains that were leading to further overvaluation.

Some regions, more inclined to the overbidding phenomenon, quickly experienced price corrections following the sharp increases, an unprecedented phenomenon in the current real estate cycle. This applies especially to the Gatineau and Montreal CMAs which were experiencing overheated conditions prior to the pandemic, and which reached, at the start of 2022, a surge in the number of sales following an overbidding process.

Several other markets were even more reactive in their price correction, in particular, resort markets such as Mont-Tremblant, Rawdon, Saint-Adèle or even markets adjacent to the Montreal region such as Saint-Hyacinthe and Granby. Other regions less vulnerable to this phenomenon did not really experience any corrections, as is the case for the Quebec City and Saguenay CMAs.

It should be noted that the regions surrounding the Island of Montreal were very prone to overbidding in 2021 and the start of 2022. Prices quickly approached those on the Island, thus creating prime conditions for a price correction.

Despite the marked slowdown in sales, market conditions continue to favour sellers

Considering the sharp decline in sales and quick price correction due to an evaporation of overbidding, it is interesting to note that market conditions remained largely in favour of sellers.

"The drop in sales has resulted in an increase in active listings, i.e., the number of properties on the market that have not found a buyer. This is a reversal in the trend which has been taking place since the second half of 2022 and indicates a turning point in an upwardly trending real estate market cycle. In fact, active listings have not seen such increases since 2016," states Mr. Brant. "The market is therefore entering a more significant slowdown phase. However, the return to more balanced conditions between buyers and sellers is very gradual."

In fact, although active listings are up significantly in many Quebec markets, they remain at historically low levels and the number of months required to sell the inventory of properties is significantly below the balanced market threshold, with sellers continuing to benefit from a very favourable bargaining power. A sizeable margin can still be observed before the property inventory becomes too large and the market swings in favour of buyers.

In most Quebec CMAs, single-family homes are tending to experience a slightly quicker easing of market conditions. The markets best positioned to maintain a lower number of months of inventory are the Quebec City, Trois-Rivières, Sherbrooke and Gatineau CMAs.

Other regions are more likely to experience a significant volume of properties coming onto the market in 2023, specifically, resort markets where properties have recently been acquired for rental purposes. This is particularly the case in the Laurentians where there is a drop in rental demand due to a context in which full-time remote work is migrating to a more hybrid formula due to the end of the health crisis. Households are also more cautious in their spending.

- FORECAST | PROVINCE OF QUEBEC

Contrasting market trends in 2023 according to the region and household purchasing power

Rapidly rising interest rates combined with record prices are exacerbating homeownership challenges in many markets. the Quebec City, Saguenay and Trois-Rivières CMAs are potentially more resilient to the increase in the cost of financing. This is also the case, to a certain extent, for the northern and eastern regions of Quebec. That being said, a normalization of their transactional activity is expected after reaching above historical averages in 2022.

For other regions, the problem of homeownership is more acute, exceeding a critical threshold. These markets are especially vulnerable to overheating and overbidding. The Island of Montreal, Laval and outlying regions are at the top of the list of markets with difficultly sustainable prices in the face of household purchasing power. Significantly more subdued transaction activity and a potentially stronger return of properties to markets in these regions are to be expected.

Ongoing decline in sales for 2023 with more balanced market conditions but still favouring sellers

Despite the marked slowdown in the economy in 2023 and in an inflationary context eroding household confidence and purchasing power, a massive number of properties coming to market is not expected. Households should be well positioned following several years of excess savings and increased mortgage prepayments during the pandemic. This should make it easier to meet the increase in monthly mortgage payments for owners who have taken out a variable-rate mortgage. Moreover, prudential rules introduced by financial authorities since 2016, such as the stress test, should continue to play an important role in market resilience. Finally, about a third or more of homeowners do not have a mortgage to repay in Canada. For the rest, in Quebec, the outstanding variable-rate mortgages, which are potentially more problematic, represent only one third of all mortgages. These factors should limit the rapid rise in active listings in 2023.

"Overall, the residential real estate market in the province of Quebec should continue to slow in 2023, although at a rate half that of 2022, i.e., with a 9 per cent drop in sales. At this rate, market conditions should remain either favourable to sellers or close to a balanced market, depending on the market. Consequently, median prices for single-family homes in Quebec should fall by only 5 per cent compared to 2022."

The clear contrast in market evolution between the Montreal and Quebec City CMAs well illustrates the difference in positioning in their respective market cycles. Consequently, the Quebec City CMA should return to a sales rate more in line with its historical average, while the Montreal CMA should stabilize around 41,000 transactions, a level comparable to that of 2016. As for prices, Quebec City should continue to register, year after year, a stabilization of the median price especially for single-family homes, while Montreal should experience a significant price drop of 12 per cent for single-family homes, erasing only the gains of 2022, and a more moderate 5 per cent for condominiums, following a 9 per cent increase in 2022. While the Montreal market may have to face short-term legislative, regulatory, or fiscal headwinds, it will benefit from real recovery opportunities as early as 2024. The CMA does indeed have multiple advantages on a national and global scale, particularly due to immigration and its position as an economic capital.

Generally speaking, the Quebec market is taking the shock of rising interest rates relatively well. The housing deficit, attributable to a delay in construction activity, does not make it possible to cope with demographic changes (such as the pre-pandemic wave of immigration). With the expected slowdown in housing starts in 2022 and 2023, there will be little chance of eliminating this deficit. This context should lead to some stabilization of the market and resulting in a more balanced market while avoiding a swing in favour of buyers.

Province of Quebec

Montreal CMA

Quebec City CMA

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 14,000 real estate brokers and agencies. It is responsible for promoting and defending their interests while taking into account the issues facing the profession and the various professional and regional realities of its members. The QPAREB is also an important player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Quebec's residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination, and exchange of information. The QPAREB has its head office in Quebec City, administrative offices in Montreal and a regional office in Saguenay. It has two subsidiaries: Société Centris inc. and the Collège de l'immobilier du Québec. Follow its activities at qpareb.ca or via its social media pages: Facebook, LinkedIn, Twitter and Instagram.

About Centris

Centris is a dynamic and innovative technology company in the real estate sector. It collects data and offers solutions that are highly adapted to the needs of professionals. Among these solutions is Centris.ca, the most visited real estate website in Quebec.

-

Quebecers Want to Know More About the Environmental Impact of a Home

- Quebecers would like to see a standardized environmental impact assessment system for housing.

- Rising prices dampen home-buying intentions slightly until 2027 in favour of renting.

- Work-from-home is ever more popular.

Montréal, December 9, 2022 — The Fonds immobilier de solidarité FTQ, the Société d'habitation du Québec, the Quebec Professional Association of Real Estate Brokers (QPAREB) and the Service de l'habitation de la Ville de Montréal unveiled today the results of a vast survey on residential real estate in Québec. Conducted by Léger in the fall, the web-based survey polled 6,755 people on their home-buying and -selling intentions in the next five years. A similar study was conducted in 2021. The 2022 edition was designed to gauge whether the pandemic is having a lasting impact on consumers' housing choices and to find out to what extent environmental factors play into these choices.

ENVIRONMENTAL IMPACT OF A HOME

Sixty-nine percent of homeowners and future homebuyers support the introduction of a standardized system for assessing the environmental impact of a home.

Of the 6,755 respondents, 42% believe that their housing decisions (living in the city, the suburbs, the countryside, in a large or small house, new or old, etc.) do not impact the environment. However, 11% believe that their choices have a negative impact. Those aged 18-34 are more likely to believe that their housing decisions have a negative impact (17%). Of note, only 36% of homeowners and future homebuyers say they have enough information to assess the environmental impact of a home. Those aged 55 and over are the most confident, with 41% saying they having enough information. Interestingly, 35% of respondents would like cities to provide information on the environmental impact of a home; 21% and 9% feel that this information should be provided, respectively, by the provincial and the federal government. Although the information should come from local government, more than two-thirds of Quebecers would like to see an environmental assessment standard put in place. This percentage rises to 72% in the Montréal census metropolitan area (CMA).

Energy performance

The survey shows that the energy performance of a home is the most important criterion for measuring the environmental impact of real estate. This criterion is cited almost twice as often as the quality of materials (in 2nd place), the reduction of travel distances and the preservation of natural environments (tied for 3rd place). The 55+ age group is more sensitive to energy performance than the 18-34 age group.

Premium for a greener home

When asked if they would be willing to pay a premium for a greener home, 56% of homeowners and future homebuyers said yes. However, this is a conditional yes, with 31% paying a premium if there were other savings to offset the additional cost and 18% if the higher price was associated with a higher resale value. Only 7% would be prepared to pay more unconditionally, a percentage that rises to 10% among 18-34 year-olds. At 50%, 35-54 year-olds are the least enthusiastic about paying a premium for a green home. Those who are reluctant to pay more might be persuaded to do so if the home was shown to be cheaper to live in and maintain or if a purchase subsidy was available.

Environmental impact of housing: renters' perspective

When choosing a place to live, renters are less concerned by the environmental impact of the home, with only 56 % saying that it affects their decision, compared to 63% in 2021. Just 30% say they have enough information to assess the environmental impact. As with homeowners and future homebuyers, renters consider energy consumption to be the most important measure of a home's impact on the environment. The second most important criterion is a location that facilitates active transportation. Fifty-four percent of renters would be willing to pay a premium for greener housing. As with homeowners, however, the majority expect this premium to be offset by savings. Just 6% of renters would pay a premium unconditionally. Those who do not want to pay a higher rent for green housing would do so if they received a subsidy to reduce the rent or if it was demonstrated that such housing is cheaper to live in and maintain.

"This year's survey confirms that people need more information to make better environmental decisions when buying or renting a home. The Fonds immobilier de solidarité FTQ is committed to ESG (environmental, social and governance) in order to promote environmentally responsible projects and reduce the environmental impact of real estate development. We all have an influential role to play in the real estate sector to demonstrate the benefits of sustainable buildings. With the right tools, people can make informed decisions that will benefit the environment, our communities and future generations."

Martin Raymond,

Senior Vice-President, Real Estate Investments, Fonds immobilier de solidarité FTQHOME-BUYING INTENTIONS

Purchase intentions are down slightly, but the proportion of buyers aiming for a rental or vacation property is up.

The effects of the overheating housing market, where prices peaked in 2022, combined with rising interest rates, are reflected in purchases, which dropped from 56% to 47% this past year. Households have been less active in 2022, with 20% of them acquiring a property in the last 5 years. The survey confirms the rise in prices, as 30% of households reported paying more than $350,000 for a property, compared to 26% of households in 2021. Rising interest are now ingrained in the public's mind and reduced buying intentions from 23% in 2021 to 21% this year. The decrease is most prevalent among 18-34 year-olds, where they declined from 47% to 45% in one year. On average, Quebecers intend to pay about $405,000 for a principal residence. Among experienced buyers, the average increases to $457,000. Compared to the last two years, it is fair to say that Quebecers have significantly increased their estimated purchase price (about +$28,000).

Households that have purchased in the past five years remain financially solid. As in 2021, 88% obtained their mortgages the first time they applied. More buyers chose a term of 25 years or more (81% in 2022 versus 75% in 2021), and 81% of mortgages are fixed rate. Eighty-two percent of households report being comfortable with their debt levels. As was the case last year, 77% of buyers have enough savings to pay the mortgage for two months.

The single-family home is still the most popular, with 79% of future homebuyers aspiring to own this type of housing.

"The rapid market slowdown precipitated by the unexpectedly large increase in interest rates has resulted in a more cautious attitude among buyers, particularly in the younger age groups, who are primarily interested in a primary residence. However, this is not the case with the older age groups, who are often experienced buyers, who have been homeowners for many years and who are generally less affected by debt issues. This explains the maintenance, if not the increase in the proportion of buyers who are more opportunistic and looking to acquire a vacation home and/or a rental property."

Charles Brant,

Director of the QPAREB's Market Analysis DepartmentRenters for longer

This year's survey reveals that 59% of tenants have been living in their apartment for more than three years, an increase of 9% from 2020. Thirty-three percent reported paying less than $700 per month in 2022, compared to 41% in 2020. The respondents' monthly rent is $902 on average in 2022. At $977, the average rent is highest in the Montréal CMA. The Québec City CMA falls in the middle at $902 while the rest of Québec is at $766.

"The data reported in this survey, combined with the low vacancy rates in several regions, underscore the importance of considering these facts before deciding to end a lease or move. People need to consider and analyze different residential options in order to make more informed decisions in this regard."

Claude Foster,

President and CEO, Société d'habitation du QuébecREMOTE WORK

Work-from-home is growing in popularity.

In Québec as a whole, one-third of workers report having worked from home. Thirty-eight percent now want to work from home 5 days a week (compared to 30% in 2021) while 22% would like to do so 3 days a week, and 84% of teleworkers want to continue with this arrangement, an increase of 7 percentage points since 2021. The reduction in commuting time (54% say they save more than an hour of commuting time per day) and the cost savings (about $127/month) are helping make this arrangement commonplace. More people say that telecommuting will have an impact on their housing choices (36% in 2022 vs. 32% in 2021). More people see remote work as an opportunity to move to a more affordable location.

About the Service de l'habitation de la Ville de Montréal

The mission of the Service de l'habitation is to support and accelerate balanced residential development in Montréal, improve the habitat and respond to urban issues by taking strategic action around built heritage and territory.

About the Fonds immobilier de solidarité FTQ

The Fonds immobilier de solidarité FTQ has been helping to drive economic growth and employment in Québec for over 30 years by strategically investing in profitable and socially responsible real estate projects in partnership with other industry leaders. It backs residential, office, commercial, institutional and industrial projects of all sizes across Québec. As of June 30, 2022, the Fonds immobilier had 47 projects worth $4.9 billion in development or construction of which the latter will ultimately create 29,000 jobs, 65 portfolio properties under management, 1.8 million square feet of land for development and a cumulative total of $181 million invested in affordable, social and community housing. The Fonds immobilier is a member of the Canada Green Building Council — Québec division.

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 14,000 real estate brokers and agencies. Its mission is to promote, represent, support and develop the practice of real estate brokerage. The QPAREB is also an important player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Québec's residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination and exchange of information. Headquartered in Québec City, the QPAREB has administrative offices in Montréal and a regional office in Saguenay. It has two subsidiaries: Centris Inc. and the Collège de l'immobilier du Québec. Follow its activities at apciq.ca or via its social media pages: Facebook, LinkedIn, Twitter and Instagram.

About the Société d'habitation du Québec

As a leader in housing, the Société d'habitation du Québec (SHQ) works to meet the housing needs of Québec citizens. To do so, it offers affordable and low-rent housing and provides a range of assistance programs to encourage the construction, renovation and adaptation of homes, as well as access to homeownership. In November 2022, the SHQ was assigned responsibility for ensuring the coherence of the government's action in housing. It works in collaboration with the Ministère des Affaires municipales et de l'Habitation, the partners and the public organizations already active in the housing sector to meet the needs of the population. To learn more about its activities, visit habitation.gouv.qc.ca.

-

Montréal CMA Households Are the Strongest Supporters of Green Housing and Are Looking to Buy

- Montréal CMA residents are most likely to buy an environmentally friendly home

- Montreal CMA residents are still likely to purchase a home in the next two years

- The popularity of work-from-home shows no sign of abating

Montréal, December 9, 2022 — The Fonds immobilier de solidarité FTQ, the Société d'habitation du Québec, the Quebec Professional Association of Real Estate Brokers (QPAREB) and the Service de l'habitation de la Ville de Montréal unveiled today the results of a vast survey on residential real estate in Québec. Conducted by Léger in the fall, the web-based survey polled 6,755 people on their home buying and selling intentions in the next five years. A similar study was conducted in 2021. The 2022 edition was designed to gauge whether the pandemic is having a lasting impact on consumers' housing choices and to find out to what extent environmental factors play into these choices.

GREEN HOUSING

Leaning green

Fifty-nine percent of homeowners and future buyers in the Montreal CMA would be willing to pay a premium for an environmentally friendly home. This is higher than the provincial average. Although this premium should be associated with savings or greater resale value, the Montréal CMA has the lowest percentage of people who would refuse to pay such a premium (33% compared to 36% for the province as a whole). Only 34% of buyers in the Greater Montréal area feel they have enough information to assess the environmental impact of a property. The Montréal CMA is also where the largest proportion of homeowners and future buyers (72%) would like to see standardized environmental assessment criteria for housing.

Green housing—tenants' perspective

Enthusiasm for green housing is slightly lower among renters in the CMA, with 56% willing to pay a premium for green housing. Only 28% say they have enough information to assess a building's sustainability.

"This year's survey confirms that people need more information to make better environmental decisions when buying or renting a home. The Fonds immobilier de solidarité FTQ is committed to ESG (environmental, social and governance) in order to promote environmentally responsible projects and reduce the environmental impact of real estate development. We all have an influential role to play in the real estate sector to demonstrate the benefits of sustainable buildings. With the right tools, people can make informed decisions that will benefit the environment, our communities and future generations."

Martin Raymond,

Senior Vice-President, Real Estate Investments, Fonds immobilier de solidarité FTQEnergy performance

In the Montréal CMA, both owners and renters rank energy efficiency as the top measure of a home's sustainability. Owners then look at the quality of the materials and whether the location reduces the need for car travel. For renters, the second most important factor is a location that facilitates active transportation, followed by material quality.

Noise pollution

This year's survey added soundproofing as a selection criterion for apartments and condominiums. This new criterion topped the list of desirable features for both condos and apartments. Limiting noise pollution emerged as a major concern for those living in residential buildings.

HOME-BUYING INTENTIONS

Buying intentions remain unchanged in the medium term

The increase in home prices had reduced the purchase intentions of Montréal households in 2021. This year, only 24% of households plan to buy a property in the next five years. However, despite the uncertainties and the increase in interest rates, 13% plan to buy a property in the next two years, the same level as in 2021. When asked why they don't plan to buy, unlike the older cohort, the youngest age group cites financial inability. Interestingly, the preference would be for urban centres if prices were more affordable, rising from 24% in 2021 to 28% in 2022. It is worth noting that concerning the time now required to come up with the down payment, respondents in the Montréal CMA most often cited 3-5 years (28% of cases), versus 24% for less than a year. However, if we look at past purchases, buyers in the Montréal CMA stand out, in 32% of cases, by having made a down payment of 20% to 30% of the price, compared to 25% last year, a proportion and an increase that is well above the provincial average.

"The rapid increase in prices over the past three years in the Montréal CMA and the sudden rise in interest rates in 2022 have had a negative impact on the buying intentions of younger buyers. However, the proportion of households that plans to purchase a property in the next two years remains stable. People have adjusted their budget since the average home price in Montréal has gone up from $440,000 to $458,000 and will remain there in 2023, and assuming they've taken into account the increase in the cost of financing. This information indicates that Montréal households still want to buy a home. This can be explained by the anticipation of more favourable market conditions and a level of savings that is significantly higher than the provincial average.

Charles Brant,

Director of the QPAREB's Market Analysis DepartmentRenters for longer

Renters in the Montréal CMA are also affected by rising prices. Twenty-eight percent said they rented because they could not buy in their neighbourhood. This compares to 22% in 2021. Due to high rents and a housing shortage, tenants in Greater Montréal are staying put. Forty-nine percent planned to move to another apartment within the next five years, compared to 59% in 2021.

"The data reported in this survey, combined with the low vacancy rates in several regions, underscore the importance of considering these facts before deciding to end a lease or move. People need to consider and analyze different residential options in order to make more informed decisions in this regard."

Claude Foster,

President and CEO, Société d'habitation du QuébecREMOTE WORK

Montréal CMA leads the way in satisfaction with remote work

In the Montréal CMA, 92% of workers who telecommute say the experience is positive or very positive. At 88% in 2021, the level of satisfaction has been rising since 2020 when it was 84%. Monthly savings (estimated at $133) and reduced commuting time (63% reckon they save more than an hour per day) contribute to the popularity of work-from-home. After more than two years of remote work, more telecommuters in the Greater Montréal area want a separate room where they can work.

About the Service de l'habitation de la Ville de Montréal

Ville de Montréal's Service de l'habitation (Housing Department) promotes balanced residential development in Montréal. It oversees the creation of social and community housing, renovation programs and AccèsLogis. It also carries out inspections to ensure the city's housing stock is fit for occupation. The mission of the Service de l'habitation is to support and accelerate balanced residential development in Montréal, improve the habitat and respond to urban issues by taking strategic action around built heritage and territory.

About the Fonds immobilier de solidarité FTQ

The Fonds immobilier de solidarité FTQ has been helping to drive economic growth and employment in Québec for over 30 years by strategically investing in profitable and socially responsible real estate projects in partnership with other industry leaders. It backs residential, office, commercial, institutional and industrial projects of all sizes across Québec. As of June 30, 2022, the Fonds immobilier had 47 projects worth $4.9 billion in development or construction of which the latter will ultimately create 29,000 jobs, 65 portfolio properties under management, 1.8 million square feet of land for development and a cumulative total of $181 million invested in affordable, social and community housing. The Fonds immobilier is a member of the Canada Green Building Council — Québec division.

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 14,000 real estate brokers and agencies. Its mission is to promote, represent, support and develop the practice of real estate brokerage. The QPAREB is also an important player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Québec's residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination and exchange of information. Headquartered in Québec City, the QPAREB has administrative offices in Montréal and a regional office in Saguenay. It has two subsidiaries: Centris Inc. and the Collège de l'immobilier du Québec. Follow its activities at apciq.ca or via its social media pages: Facebook, LinkedIn, Twitter and Instagram.

About the Société d'habitation du Québec

As a leader in housing, the Société d'habitation du Québec (SHQ) works to meet the housing needs of Québec citizens. To do so, it offers affordable and low-rent housing and provides a range of assistance programs to encourage the construction, renovation and adaptation of homes, as well as access to homeownership. In November 2022, the SHQ was assigned responsibility for ensuring the coherence of the government's action in housing. It works in collaboration with the Ministère des Affaires municipales et de l'Habitation, the partners and the public organizations already active in the housing sector to meet the needs of the population. To learn more about its activities, visit habitation.gouv.qc.ca.